A significant market of financial services has emerged in the automotive sector. Leasing contracts, credits and extended guarantees – including used vehicle warranties – are offered to car owners. However, the resulting convenience for customers comes with a price of an increased insecurity for banks and manufacturers. We support our project partners with solutions to tackle arising problems within this context:

Data Science in the Automotive Industry

Example: Modeling and Valuation of Leasing Contracts

A main challenge for companies that offer leasing contracts is to exactly determine the so-called »residual value« of a vehicle. Hereby, the »residual value« defines the value of a vehicle at the end of the contract. For the German market this value can be retrieved only at the very end of each contract based on the so-called »Schwacke«-list. For other markets this achievement is even more complex. Hence, several interesting questions arise:

- How does the value of the vehicle evolve over the contract period?

- Which characteristics of the contract or vehicle features are most relevant to determine the residual value?

- Which value of the leasing contract should be depicted in the books?

- Which amount has to be retained in order to cover risks?

To answer these questions, we have derived a model for leasing contracts. Using the model, predictions of the »residual value« are made depending on the remaining term. Furthermore, accuracies of these predictions are provided and even increase with the contract approaching the end.

In comparison to the benchmark, our model achieves lower mean squared deviations from the actual »residual value«. With other words, our model yields more reliable prognoses at the beginning of the contract as well as during the contract period. Hence, it represents a significant improvement of the standard approach.

Example: Revenue Forecasts in Vehicle Financing

In the automotive sector, caaptive finance companies experience a high demand of financing inquiries. However, not every inquiry results in the closing of a contract. Therefore, financial service providers are in need of reliable planning. This leads to several questions:

- How high is the probability that inquiries result in contracts?

- How much time passes between an inquiry and a closing?

To find answers for these questions, we have modeled the probabilities of closing as well as the distribution of the duration until closing. For this model we used a data-driven approach. As result, revenues can be predicted with daily accuracy.

Example: Interactive Analysis for Used Car Warranties

Several insurers offer used car warranties: these are insurance policies against premature wear and tear or defects in vehicle components. These policies are important to owners wanting to reduce the risk of high cost maintenance after the expiration of a new car warranty. Of course, the suppliers of such insurance products have to worry about their own profitability.

Our software helps customers merge data from various sources and automatically aggregate it to useful data sets. It also offers new opportunities for exploratory data analysis. Another innovative development is specific anomaly detection. This feature uses statistics and machine learning techniques to automatically search the data for conspicuous patterns. These patterns reveal aspects that, in turn, allow:

- better workshop control

- more efficient application review

- more efficient contract design

- optimization of internal processes.

Major aspects of the project are understanding the available data and predicting future costs. To this end, the decision maker has various actuarial methods available that can be adapted to fit the context. Comprehensive back-testing of historical data enables a reliable assessment of the forecasting quality. Based on R-Shiny technology, a web application was created that enables customers to work interactively with the data.

Development and Modeling

Provided solutions are developed according to business requirements. Possible solutions are:

- Management Software

- Advanced Analytics Software

- Further special cases

The results are delivered as independent software or integrated into already existing business processes. Optional documentation provides information about functionalities of the product as well as statistical results.

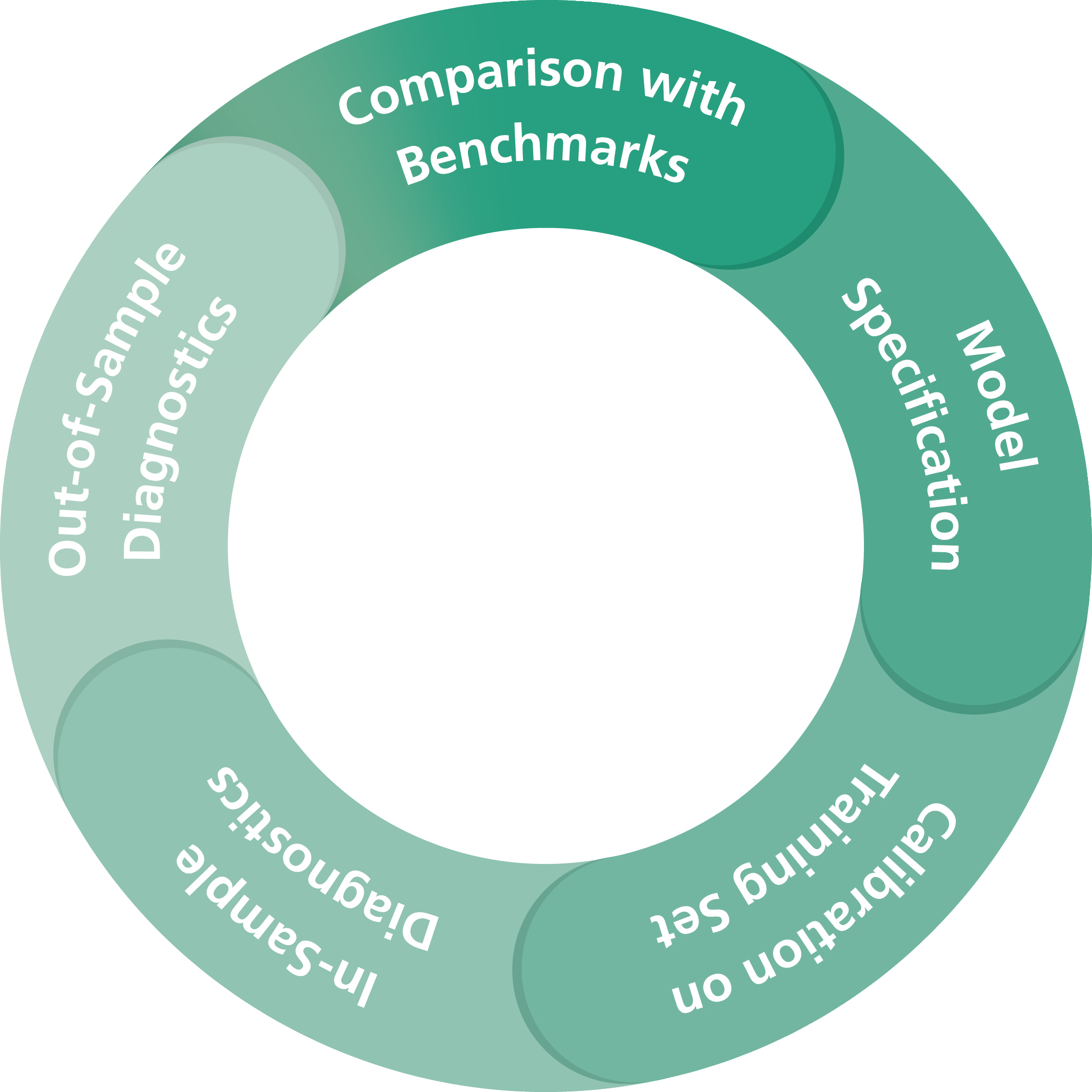

For validation of models and methodical optimization, error measures are calculated. Usually we consider in-sample and out-of-sample measures in order to be able to provide differentiated views on the model quality. Already existing models are commonly used as benchmarks. Furthermore – for cross-validation – we split data into training and test sets. Popular splitting schemes are:

- randomized

- chronological or

- consistent to currently existing business processes.

For the model development, we also examine information from contracts as well as vehicle features in the following manner:

- Algorithmic grouping of motors via cluster analysis

- Dimensional reduction via Principal Component Analysis (PCA)

- Modeling of expert knowledge (Grey-Box Modeling)

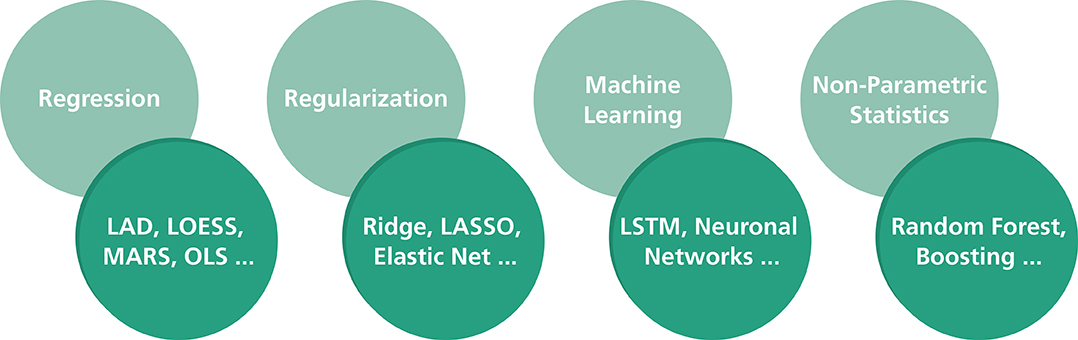

We then use the resulting outcomes for the analysis of several different types of forecast. The figure »Modeling Approaches« on the right shows an overview of our most commonly used approaches.